child tax credit 2021 amount

The credit amounts will increase for many. The 2 of inaccuracies left.

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

21 audit from the Treasury Inspector General for Tax Administration shows that the IRS was 98 accurate in sending 2021 child tax credits.

. The 2021 Earned Income Tax Credit provides a tax break for low-income workers and families based on their wages salaries tips and other pay as well as earnings from self-employment. Added January 31 2022 Q A9. How much is the income tax credit for 2021.

Since the child tax credit is refundable for 2021 many families have a chance to get a tax refund. Due to the American Rescue Plan enacted March 2021 the 2021 child tax credit was raised from 2000 per child to 3600 for children 5 and under and 3000 for all other. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from.

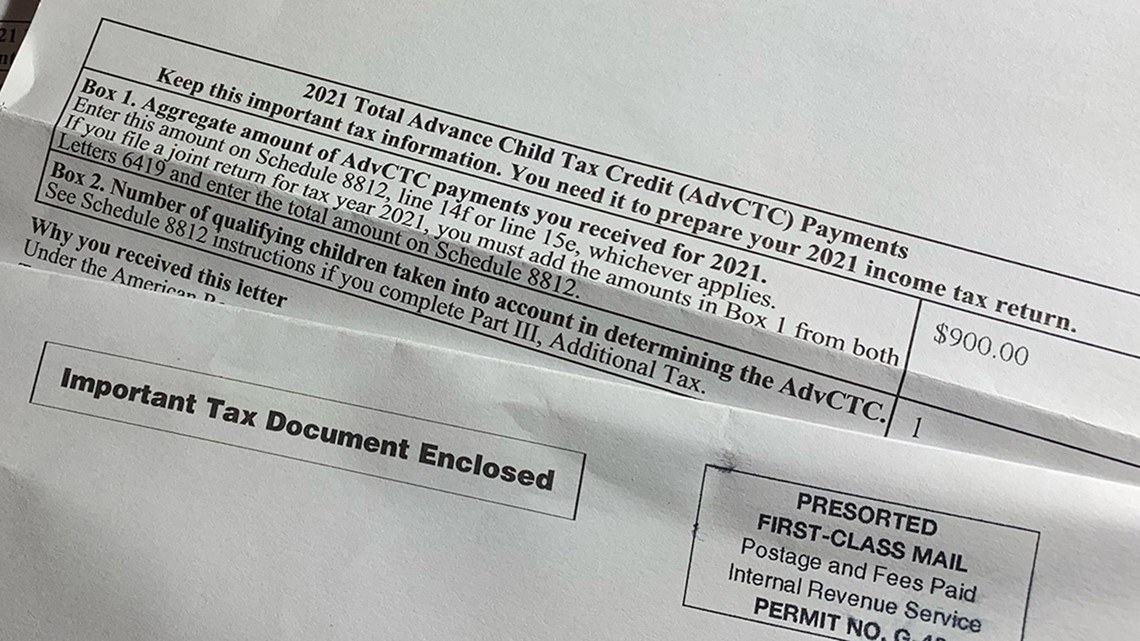

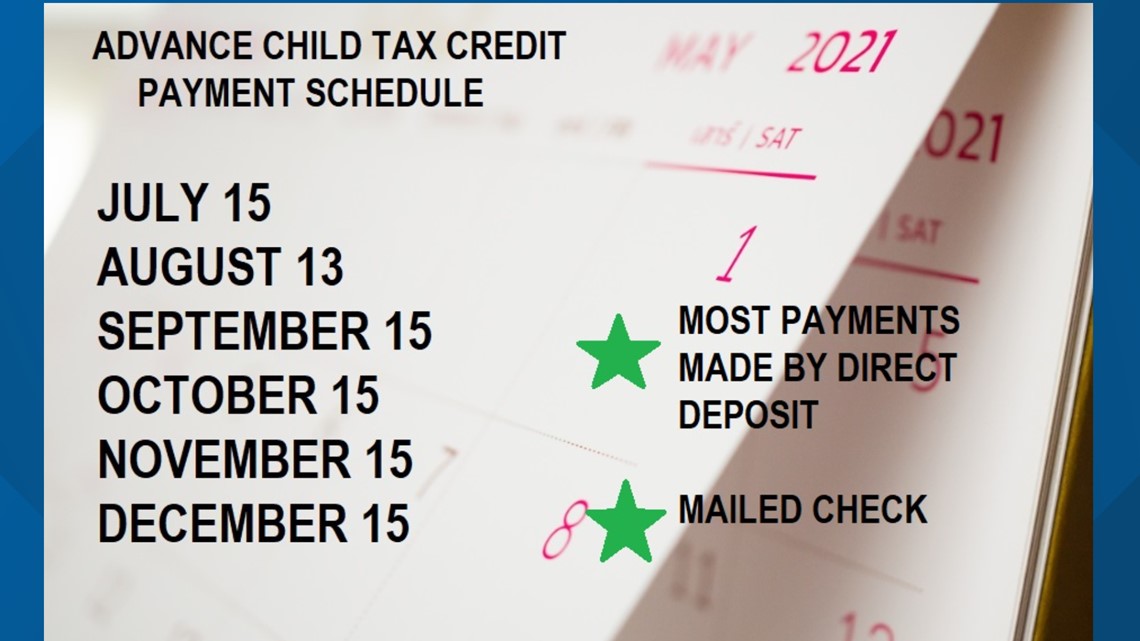

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. To get money to families sooner the IRS is sending families. In January 2022 the IRS will send you Letter 6419 to.

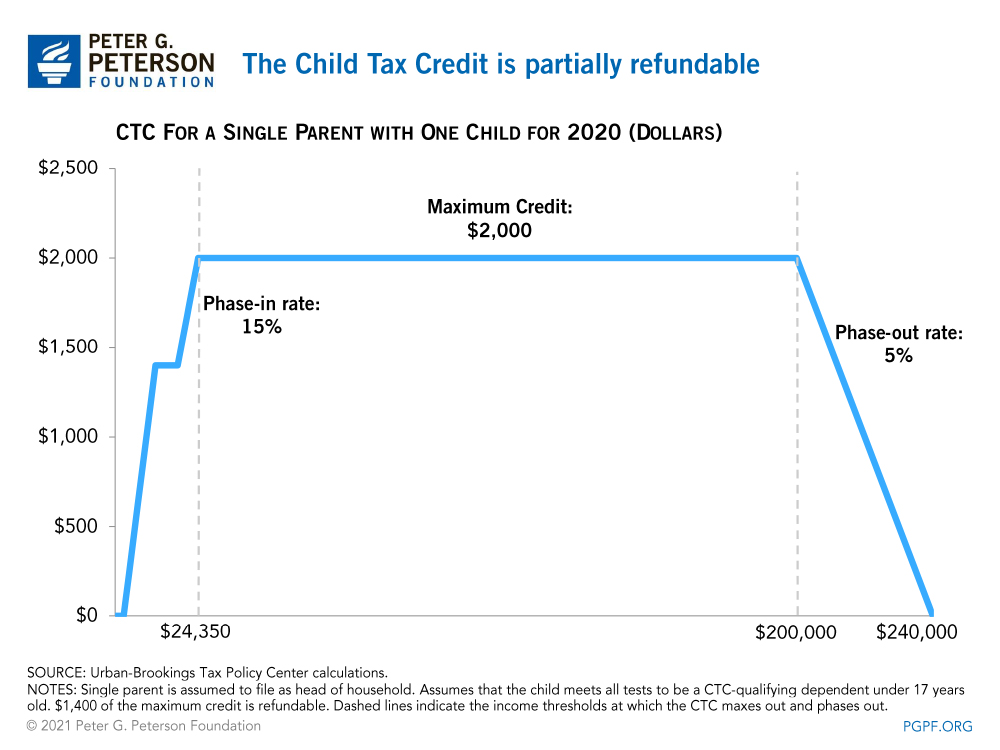

How does the first phaseout reduce the 2021 Child Tax Credit to 2000 per child. Children who attend college are qualifying children for. Although the Child Tax Credit CTC has reverted to its original amount of 2000 per child for the 2022 tax year there is still time to cash in on the expanded CTC of 2021.

The credit amount depends on your income marital status and family size. Learn more about the Advance Child Tax Credit. Most families will receive the full amount.

If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the. Can my Child Tax Credit amount be reduced based on the amount of my 2021 income. Find COVID-19 Vaccine.

In 2021 the credit is worth up to 6728. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

All eligible families could receive the full credit if. How does the second phaseout reduce the Child Tax. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

When you file your 2021 tax return you can claim the other half of the total CTC. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. View complete answer on irsgov.

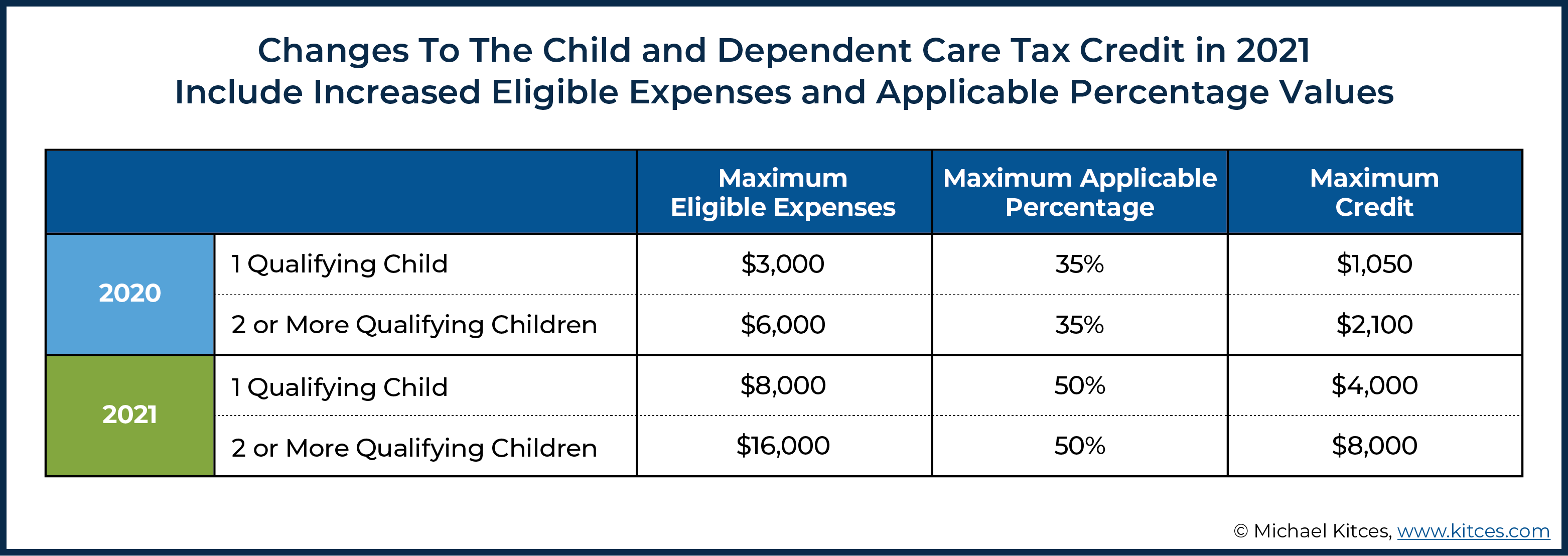

If you havent filed a tax return before or dont file every year and are eligible for the Child and Dependent Care Credit be sure to file to receive the credit this year. Updated March 8 2022 Q C2. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. It also provided monthly payments from July of 2021 to. If you requested a tax extension on April 18 you have two weeks.

Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of 3600 per child. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. You can file a 2021 tax.

Visit ChildTaxCreditgov for details. The credit amount rises with. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

What is the amount of the Child Tax Credit for 2021. The amount changes to 3000 total for each child ages six through 17 or 250 per. To be a qualifying child for.

That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. 3600 for each child under age 6 and 3000 for each child ages 6 to 17. The Child Tax Credit will help all families succeed.

Disbursement of advance Child Tax Credit payments.

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

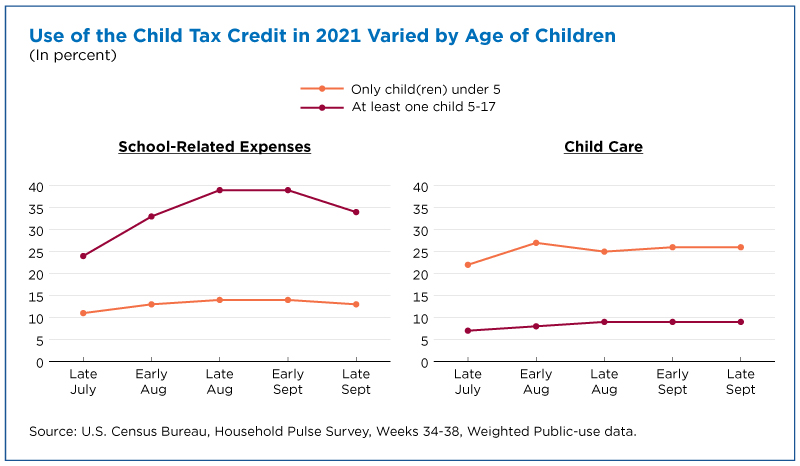

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Should You Opt Out Of The Monthly Advance Child Tax Credit Payments Traverse Planning

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Child Tax Credit 2021 Why Opt Out Of Monthly Payments Money

Tax Breaks For Parents In 2021

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Check Advance Child Tax Credit Economic Impact Payments On 2021 Tax Returns

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNCZCGZXXVB57LZHLUY5ZJ7BMM.jpg)

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Tas Tax Tips Early Information About Advanced Child Tax Credit Payments Under The American Rescue Plan Act Taxpayer Advocate Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash Wkrc

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information